Key Findings

Introduction

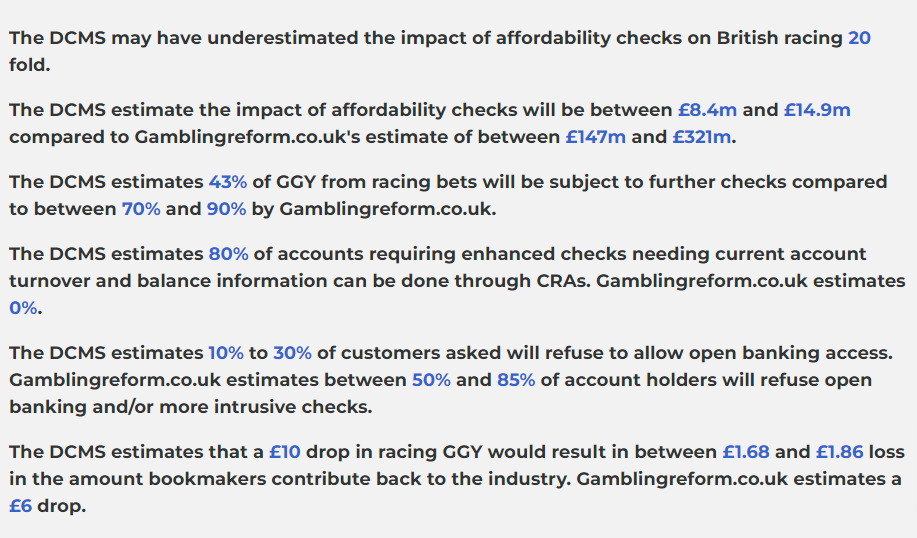

The Department for Culture, Media & Sport estimated the impact of their online financial risk protections on horse racing in ’High Stakes: Gambling Reform for the Digital Age’. They concluded the cost would be between £8.4m and £14.9m. This represented between 0.5% and 1% of racing’s total income of £1.47bn.

We estimated in ‘Potential Impact of Enhanced Financial Risk Checks on British Horse Racing’ that the impact of the measures would be a drop in income between £147m and £321m within 2 years. This is between 10% and 22% of racing’s total income. Our estimate does not include potenital knock on effects of reduced owner and racegoer interest due to betting restrictions.

This article examines the assumptions in DCMS methodology that may have caused them to underestimate the impact 20 fold. We examine the proposed financial risk checks on a gambler losing £1,000 in a day or £2,000 in a rolling 90 day period.

Assumption 1

The loss in online gross gambling yield (GGY) will be impacted exactly the same for online slots, casino games, sports and racing bets.

The same broad data set has been used to measure impact when 70% of slots GGY comes from 5% of accounts and 70% of racing GGY comes from 1% of accounts.

The different products have completely different usage profiles. This was detailed in the types of gamblers report which showed the difference in variance of results for racing and roulette gamblers.

For all betting (racing and sports) the 5% of accounts with the highest spending (loses) generated 86% of GGY. This compares to 70% of GGY for online slots and 61% for online bingo. Andrew Rhodes, CEO of the Gambling Commission, also told Racing TV that 70% of online horse racing GGY comes from 1% of accounts.

Assumption 2

3% of accounts will be impacted by the checks at proposed thresholds.

This assumption is based on data collected for the Gambling Commission in May 2020-April 2021. The accounts included sports betting, betting on racing and casino games. With the financial checks due to come in for the summer of 2024 inflation means 4.1% of all accounts will be impacted if the thresholds are not increased.

Furthermore, due to variance in racing results compared to casino games and the increasing number of people caught up in the checking process through time we estimated 4%-6% of racing betting online accounts would be impacted within 2 years.

Assumption 3

43% of online GGY is linked to the top 3% of accounts after loses up to thresholds are taken into account.

The assumption is based on the top 3% of online accounts being able to lose either £1,000 in a day or £2,000 in a rolling 90 day period before they would be impacted.

This would be the case in the first year of any new betting or gaming account. But through time most accounts that are going to reach the threshold will reach the threshold. The owners of those accounts will then have to consent checks or have deposits suspended and accounts potentially closed.

We estimated 70% to 90% of bookmaker GGY from racing bets will be impacted by the checks. The lower threshold of 70% is the contribution from just 1% of accounts.

Assumption 4

80% of enhanced checks can be done totally frictionlessly through credit reference agencies (CRAs).

The Gambling Commission stated in the consultation in financial risk checks:

We have agreed with DCMS that the proposal for consultation to take this forward would include:

personalised data relating to a customer's credit performance and income and expenditure data, such as current account turnover, or a risk assessment based on this data.

We do not think it would be possible for a betting operator to obtain full expenditure and income information on a customer from CRAs. They hold information on CCJs, IVAs, debt levels, if payments have been made on time and fraud. We find no evidence that CRAs can provide full current account information.

We assume that 0% of enhanced checks can be done through CRAs.

Assumption 5

70%-90% of asked customers will agree to allowing betting operators open banking access to their banking history and 20%-50% of asked customers will be willing to send in more intrusive information.

Open banking sounds attractive but it still requires the customers to agree to let a betting operator have access to their historical digital bank statements. Whilst customers might be willing to do this to get a loan off a trusted financial institution the motivation is completely different in order to place a bet. 70%-90% compliance appears to be a very high estimate.

We estimated that 15%-50% of asked customers would be willing to comply with open banking and/or giving physical financial information such as pay slips, tax returns and bank statements. 50%-85% will refuse. This was based on a number of surveys.

Assumption 6

Betting operators will decrease their expenditure on media rights and sponsorship by £3.4m if their racing GGY drops by £50m (£6.9m if racing GGY drops by £80m).

The DCMS estimated that the impact of the financial risk checks would be between 0.5% to 1% of total racing income based on a total of £1.47bn a year.

The assumption starts by assuming the GGY from online racing bets would drop only by 6%-11%. This assumption feeds into a Horserace betting levy drop of between £5m and £8m a year. They assume that betting operators will still have an incentive to promote racing, stream racing and have sponsorship deals. Due to this they estimated a drop in sponsorship and media rights of £3.4m to £6.9m a year.

We estimated a far bigger drop in spending by betting operators on racing. We assumed that if GGY fell considerably then betting operators would reduce spending at a proportional amount. Betting companies contribute c.£600m into racing from c.£1bn in racing GGY. We assume that a £10 reduction in racing GGY would ultimately mean a £6 loss in money going into racing. This compares with the DCMS estimate that a £10 reduction in racing GGY means a £1.68-£1.86 loss in money going into racing.

Conclusions

The 20 fold difference in the estimate of the impact of financial risk checks on British racing has been caused by different assumptions being used.

The DCMS estimates 43% of GGY from racing bets will be subject to further checks compared to 70%-90% in our report. This is due to our report using a longer time frame (2 years rather than 1), only using racing betting data (rather than all gaming and betting data), taking inflation into account and ignoring bets before the customer reaches a threshold. This means our report doubles the impact.

The DCMS estimates 80% of accounts for enhanced checks requiring current account turnover and balance information can be done through credit reference agencies and there will be a 70%-90% compliance rate for open banking. We think all checks will have to be done through open banking and/or intrusive checks, both with a 15%-50% compliance rate. This results in our prediction of over reduction in GGY by affected accounts being 50%-85% compared to 14.4%-27.1% for the DCMS. This means our report trebles the impact.

Finally the DCMS assumed a £10 drop in racing GGY would result in £1.68-£1.86 loss in the amount bookmakers contribute back to the industry. Currently betting operators put £600m of the £1bn a year GGY they get from racing bets back into racing (60%). We therefore assume a £10 drop in GGY will result in a £6 drop in contribution to racing. This is 3.5 fold difference.

The combined difference of the three contributors means that our report estimates the impact of the financial risk checks on British Racing will be 20 times greater than suggested by the DCMS in their White Paper.

To read our full report 'Potential Impact of Enhanced Financial Risk Checks on British Horse Racing' click here.