A freedom of information request has finally revealed the sheer scale of public opposition to affordability checks in a 2021 survey conducted by the Gambling Commission. Questions must be asked as to why the results of the survey were kept secret for so many years as the debate on affordability checks raged. Members of the public, campaigners, academics and policy-makers have been deprived of the full facts. This has potentially set back finding a practical solution to help reduce gambling harm many years.

Context

Betting consumers have been subject to affordability checks (re-branded as financial risk checks in the Gambling White Paper published by the government in April 2023) since 2019. During that time there has been a sharp drop in legal post-inflation betting turnover on racing and sports according the Gambling Commission official statistics. A new pilot for financial risk checks is set to start in August 2024.

In January 2021 the Gambling Commission conducted a survey into affordability checks. The results of this survey remained unpublished until they were finally released in June 2024 due to a Freedom of Information request.

Summary of results

The results of the survey showed that the public were overwhelmingly against affordability checks.

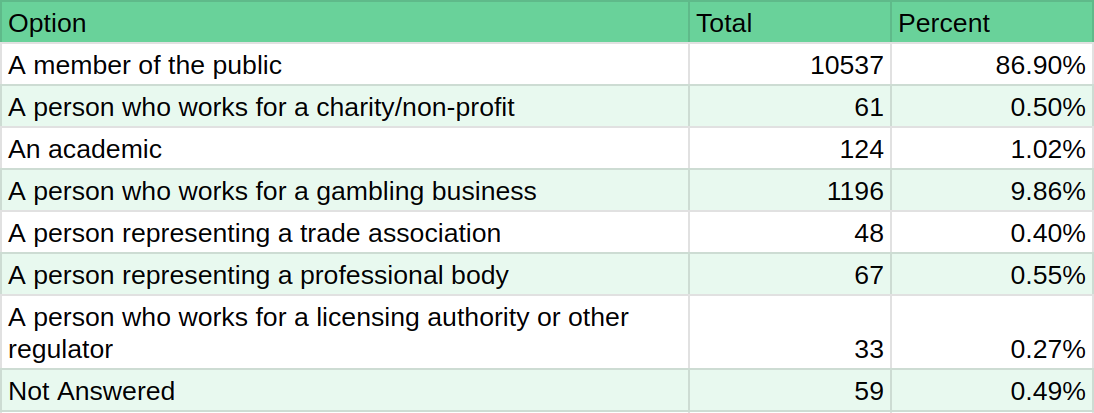

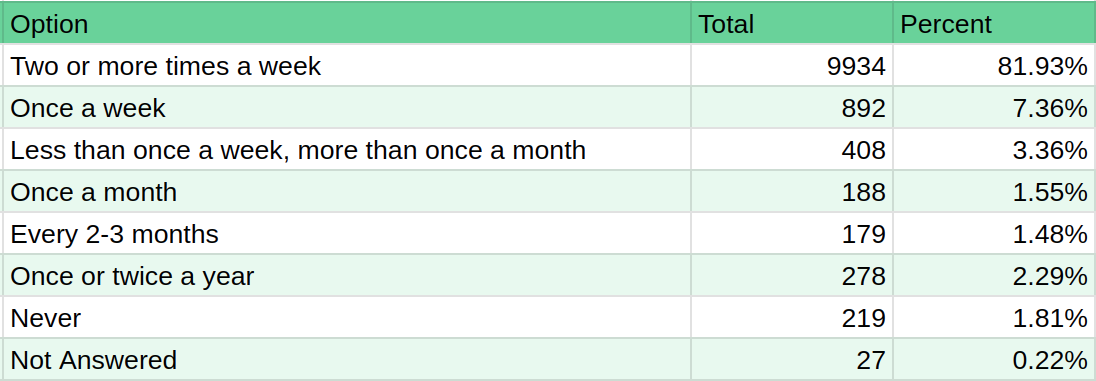

87% of the 12,125 respondents were members of the public (the rest were largely made up of charities, academics and those working in the industry). 82% said that they bet more than twice a week. This meant that those surveyed were very engaged in betting and the very people likely to be subject to affordability checks. This cohort of gamblers represent the vast majority of betting turnover in the UK.

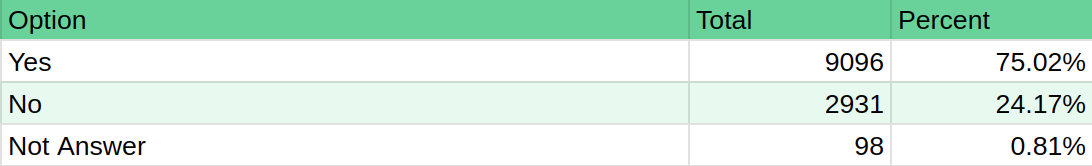

77% of respondents said that gambling businesses should not be required to assess if gambling is affordable.

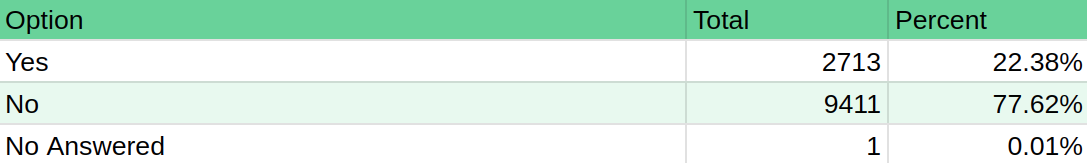

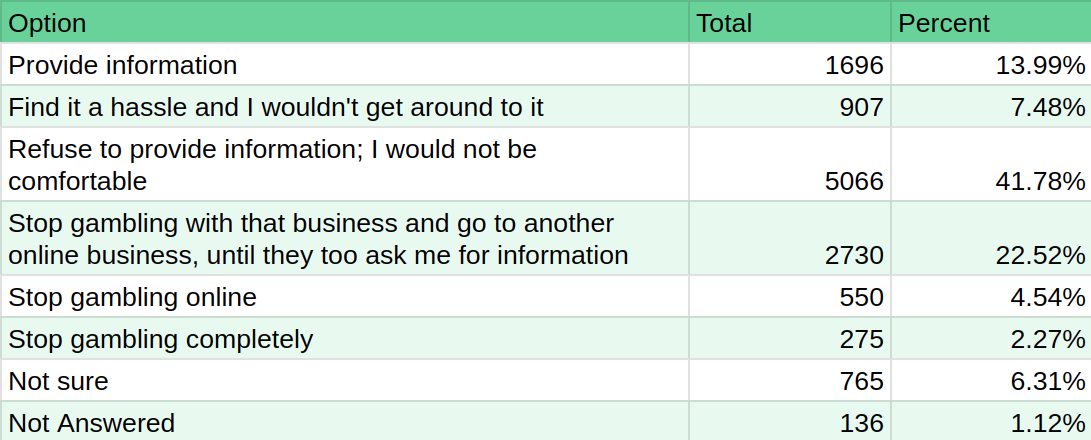

Only 14% of those asked said they would be willing to provide information to a gambling business to assess if their gambling was affordable (remember 13% of the sample were NOT members of the public).

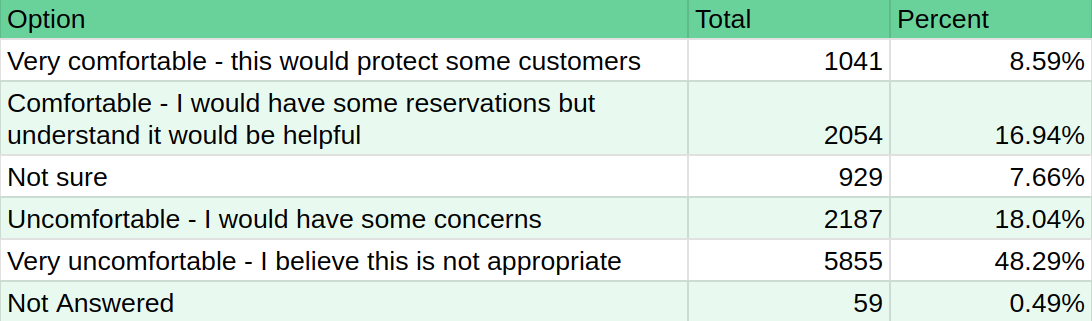

Only 8.6% said they would be very comfortable with gambling businesses accessing information on them from credit reference agencies under the prompt that it 'would protect some customers'. The vast majority were uncomfortable.

Despite very few engaged gamblers saying that they would be willing to submit information to betting companies only 4.5% said they would stop betting online. This implies gamblers would move to another operator if checks were requested potentially leading them to black market firms once UK licensed options run out.

The combined results that only 14% of respondents would provide information and that only 4.5% would give up betting online suggests that the concept of affordability checks was doomed from the start.

(See the full results)

Implications of the results remaining unpublished for so long

The results from the 2021 survey tell us that a tiny percentage of engaged gamblers would be willing to submit personal information to gambling operators to assess if they could afford to bet. A tiny percentage were also comfortable with betting organisations accessing information on them through credit rating agencies.

Given that this information was available to the Gambling Commission in February 2021 it is astonishing that they pursued the affordability checks policy regardless.

Following the 2021 consultation there have been two Department of Digital, Culture, Media and Sport Committee hearings with Andrew Rhodes of the Gambling Commission, a Government White Paper, another public consultation and a debate by MPs on affordability checks.

By holding back this data the Gambling Commission has denied MPs, members of the public, academics, charities, the racing industry and the betting operators the opportunity to use this vital knowledge when consulting on the policy.

Now it has come to light that engaged gamblers are so deeply opposed to affordability checks (even if done through credit references agencies) a new solution to help prevent gambling harm has to be developed. Group think at the Gambling Commission and at the DCMS needs to be replaced with innovation and new ideas. The holding back of this vital data has delayed the process by three and half years and caused unnecessary damage to consumers, operators and the racing industry.

This saga has resulted in huge trust implications for the Gambling Commission. How can MPs, consumers, academics, charities, the betting industry and horse racing trust any survey results the Gambling Commission decide to publish in future if they retain the right to pick and choose which ones they publish and which ones are withheld?

Timeline of events

In January and February 2021 The Gambling Commission carried out a survey into affordability checks. Over 12,000 people took part in the survey.

The results of the survey were not published by the Gambling Commission in 2021. In June 2022 Andrew Rhodes, CEO of the Gambling Commission, was asked a by the Chair of the Digital, Culture, Media and Sport Committee to comment on why the survey results were not published.

Andrew Rhodes, who had been in charge of the Gambling Commission for over a year by this time, replied:

In April 2023 The Government published the Gambling White Paper. The appendix of the document contained an estimate of the cost to British Horse Racing from financial risk checks at around £15m a year. This included assumptions on how many people would be willing to supply private information to bookmakers for affordability checks. It is unclear if these assumptions were based on data from the unpublished survey. British Racing estimated the costs of the checks would be £250m over 5 years. We estimated the cost to be between £147m and £321m a year based on our estimate that 50% to 85% of those asked would refuse to submit information.

The implication of this reduction in legal betting due to consumers refusing to comply with checks and the survey results that only 4.5% would stop online gambling completely is a big boost for black market operators. This would result in a drop in tax revenue and racing funding. With 95.5% of consumers continuing to bet online regardless the implications for reducing gambling harm are, at best, neutral. If consumers migrate to unlicensed firms that offer less harm protection measures gambling harm levels will ultimately increase.

In July 2023 the Gambling Commission launched a public consultation into the White Paper proposals. Had the public, academics, charities, industry analysts and the racing industry had access to the survey results at this point it would have been much easier to build a case against the checks based on the Gambling Commission's own data. Focus could have shifted to developing a more practical solution.

Regulus Partners made a Freedom of Information request to obtain the survey results in October 2023. The Gambling Commission rejected this request. That same month the public consultation closed.

In November 2023 the head of the Jockey Club launched a petition to parliament to 'Stop the implementation of betting affordability/financial risk checks'.

Over 100,000 people signed the petition and it was debated in Westminster Hall by MPs in February 2024. The Parliamentarians, and those briefing them, still did not have access to the survey results to make the case for an alternative solution.

On 1st May 2024 a financial risk checks pilot scheme was announced by the Gambling Commission. The pilot scheme is using credit reference agencies to obtain information on customers - something only 8.6% of respondents to the 2021 Gambling Commission survey were very comfortable with.

On the same day a narrative description of the 2021 survey was finally published by the Gambling Commission. This narrative failed to provide the actual statistics from the 12,000+ respondents. Instead it contained vague phrases such as:

In June 2024 Dan Waugh, from Regulus Partners, again requested by FOI that the Gambling Commission reveal the full survey results. Under this increased pressure the Commission finally released the results that showed just how much against affordability checks the public had been from the start.

Dan Waugh told the Racing Post:

Full Timeline

Full Survey Results

Tell us a little bit about you to help us understand your perspective. Are you:

How often do you gamble?

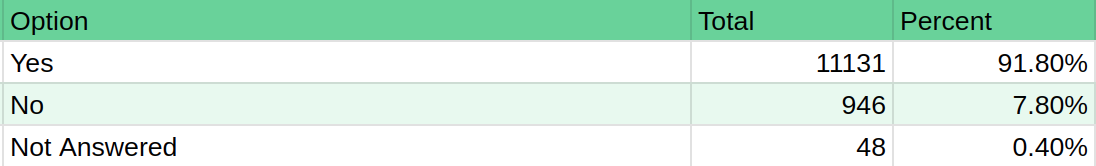

Have you gambled online in the past 4 weeks?

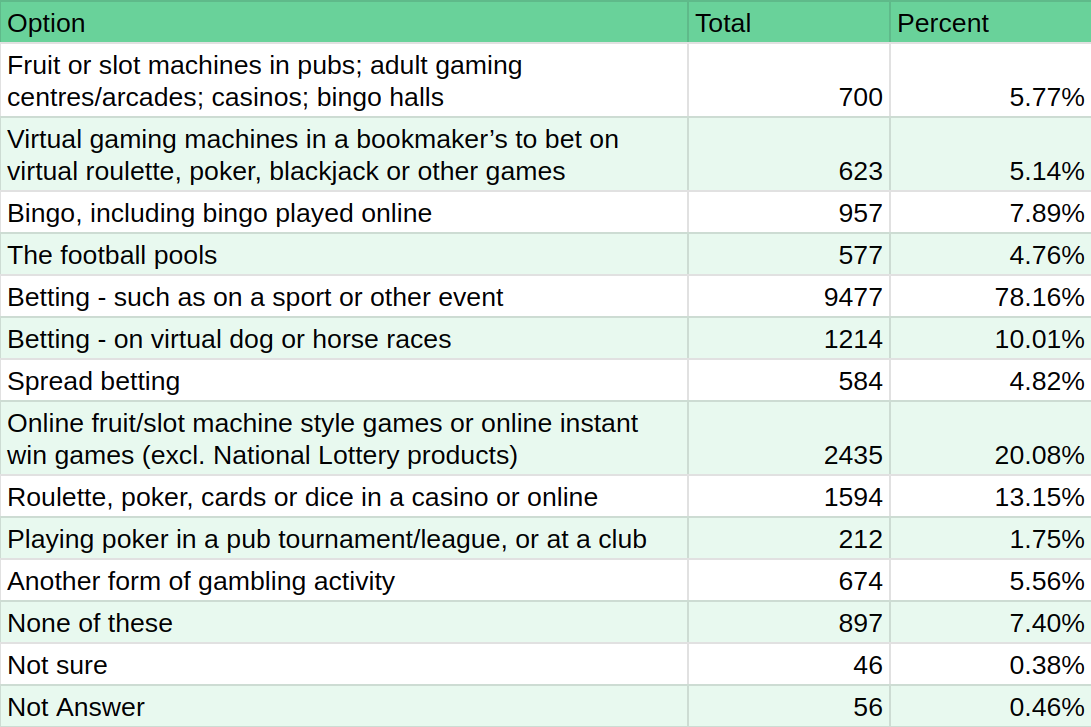

Have you spent any money on any of these gambling activities in the past four weeks?

When gambling businesses are aware that a customer is in a vulnerable situation, should they be required to take action to support that customer?

What are your reasons for saying that gambling businesses should not take action if they are aware a customer is in a vulnerable situation? (You can select multiple options)

Do you think gambling businesses should be required to assess if gambling is affordable?

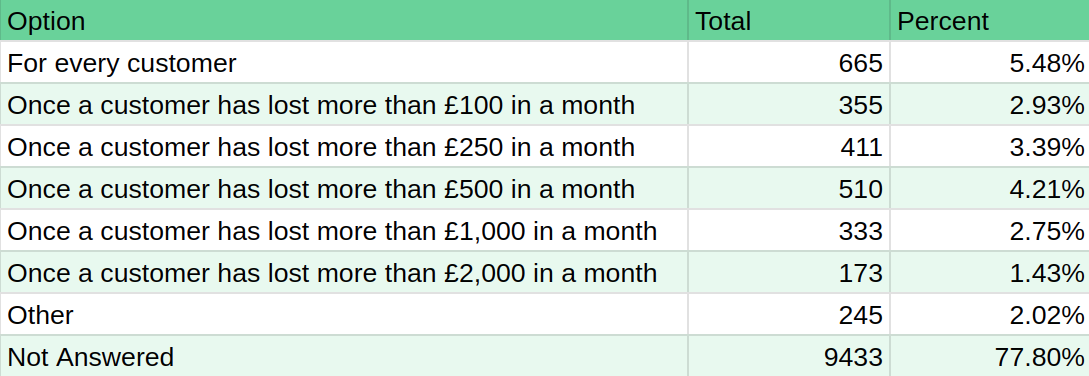

At what level do you think gambling businesses should be required to assess if gambling is affordable?

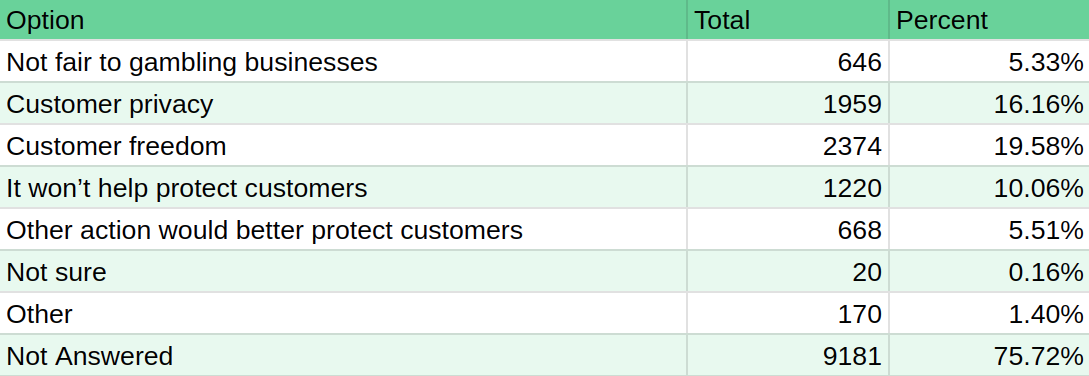

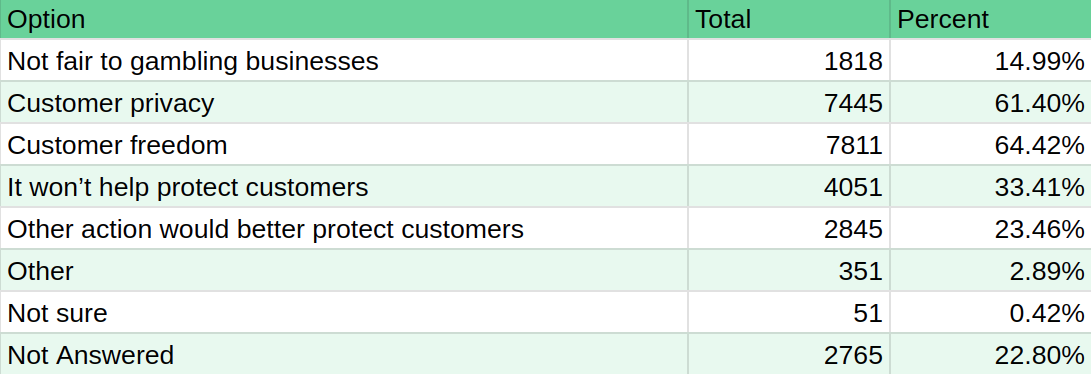

What are your reasons for saying that gambling businesses should not assess if gambling is affordable? You can select multiple options.

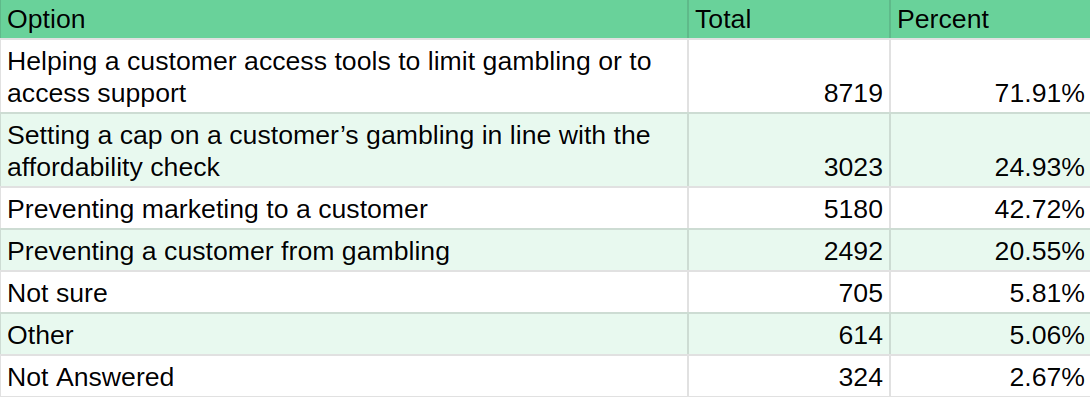

What action should gambling businesses be required to take if there are signs of harm? This could be after an affordability check or if there is other information which may be a risk flag.

If a gambling business asked for information from you to assess whether your gambling is affordable would you...?

At the moment, gambling businesses can access limited information about customers from third parties such as credit reference agencies. How comfortable would you feel about businesses accessing more information like this as a way of completing an affordability check?

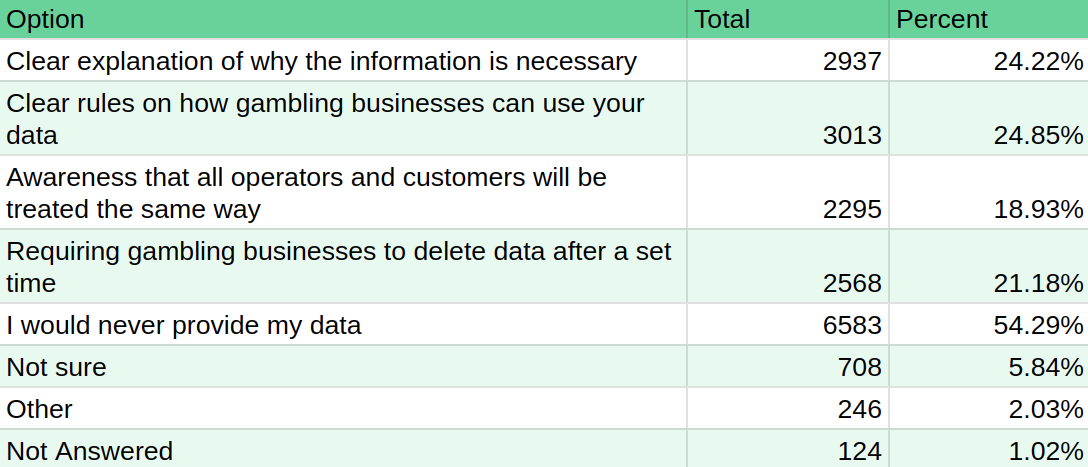

What would make you/consumers more comfortable to provide information to a gambling business or give permission for information to be accessed?

____________________

Read our assessment of financial risk checks on racing here.

Read the impact of financial risk checks on different types of gamblers here.

Don't forget to join our 11,000 followers on X at @SharpBettingGB.

Today's racecards and our Quick Pick tools are available here.